PropNex Picks

|January 06,2026Worried You Bought the 'Wrong' Property?

Share this article:

In any kind of investing, the biggest fear is always the same: What if I pick the wrong thing?

Buy the wrong stock, and it tanks. Choose the wrong crypto, and it goes bust.

So it's perfectly normal that homebuyers and first-time investors feel this worry too. After all, homes cost a lot more than stocks or ETFs. And when you don't have any clue about how the market works, you might give in to your fear. When in reality, even underperforming properties can still make money in Singapore.

If you take a moment to understand how the market actually works, you'll realise that even if you bought the "wrong" unit, you may still be better off than you think.

When people say a property underperformed, they usually mean one of three things:

* It didn't beat the market average

* It didn't outperform other projects nearby

* It didn't meet their personal expectations

But that doesn't automatically mean it lost money.

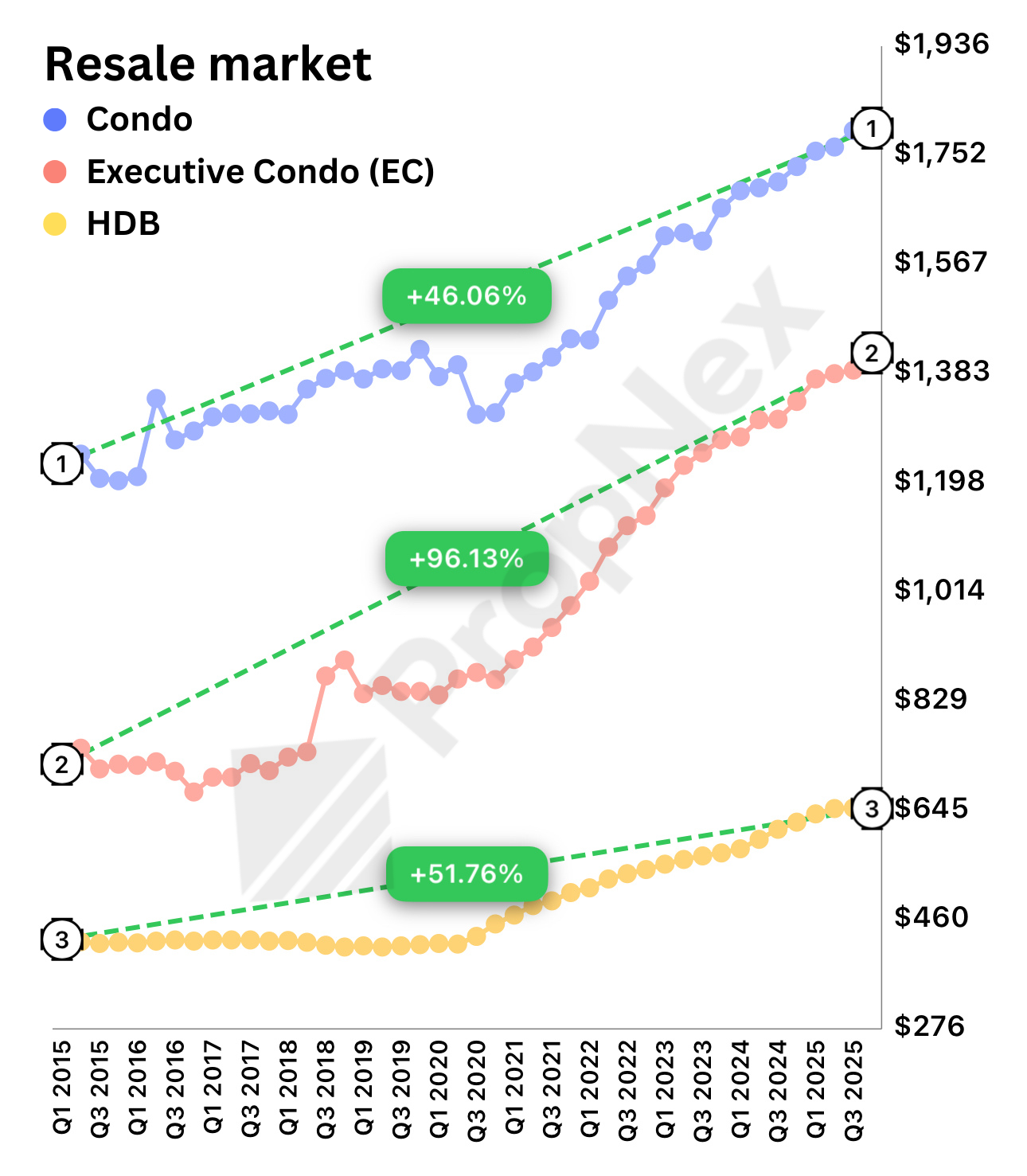

In fact, both private and HDB prices consistently show upward trends in the long run, even though individual years may fluctuate. Just take a look at the resale market. Over the past decade alone, Condo prices rose by 46.06%, followed by HDB at 51.76%, while EC saw a 96.13% growth.

Source: PropNex Investment Suite

The pattern is hard to ignore. Short-term stagnation and sideways movement can happen, especially with HDB. However, capital loss is rare unless someone exits at the worst possible timing. So even if your property isn't the best performer, it's still very likely to make some profit over time.

For one thing, Singapore's property market behaves very differently from other countries. Because of land scarcity, controlled supply, strong rental demand, and structured regulation, the long-term trajectory is biased upwards.

If anything, you could "lose" more money waiting around for the perfect timing. In a market that keeps rising, lost time often means lost momentum. By the time you're "ready to buy", the entry price is already higher. This is a common trap many buyers fall into, which I talked about more in depth in this other article.

And when it comes to actual loss, more often than not, it occurs not becausethe property failed, but because owners exit at the wrong time. As we already discussed, given enough time, the market has shown the ability to recover from dips. But when people are forced to exit early, usually due to panic selling or unexpected financial pressure, they end up losing before the market bounces back.

Like all asset classes, property markets move in cycles, swinging between fear and greed. And it's important to understand how these emotions play out so that you can make smarter decisions.

When there's fear in the market, buyers freeze. People worry about price crashes and fixate on every negative headline. Uncertainty takes over. During these periods, sellers may sense slowing demand and cut prices. Meanwhile, buyers are hesitant to act, waiting until conditions "improve".

Ironically, these are often the times when real opportunities emerge, when sellers (even developers!) become more flexible, and market activity slows enough to give buyers the upper hand.

On the other hand, when the market is heating up and prices rise quickly, suddenly everyone's greedy. Sellers raise their prices, and yet buyers still rush in because they're scared they're going to miss out. However, people who bought during the greed phase usually regret it later, feeling they overpaid but are getting less returns.

But remember, less profit does not mean no profit.

Again, because of Singapore's special circumstances, even when buyers enter during less-than-ideal moments, many still end up making money over time, just not as much as they might have if they didn't let their emotions lead their decisions.

This is precisely why understanding fundamentals matters far more than trying to predict the peaks and valleys. Long-term success is shaped by holding power, cash-flow resilience, and disciplined decision-making, not emotional reactions to headlines.

It's also why seasoned investors rely on structured frameworks that prioritise fundamentals over fear and greed. Here's a short clip of our CEO, Kelvin Fong, explaining a little bit about this behavioural cycle:

If you're worried your property is truly underperforming, ask yourself these questions:

- Are you still able to hold the property comfortably without financial strain?

- Is the property producing rental income?

- Has its value at least kept pace with the broader market over time?

- Would the same property cost significantly more to buy today?

If the answer to most of these is "yes", then chances are your property isn't a total failure. It's just progressing at a slower pace, and that's okay. Owning the asset is already half the battle won anyway.

In Singapore, even the "wrong" property rarely loses money.

You may not have bought the best performing property, but that's totally fine. Not every purchase needs to be a homerun for it to work out. In Singapore's forgiving market, even average or slow-performing homes often still deliver positive outcomes over time, especially when owners have the ability to hold and manage their finances responsibly.

Rather than viewing it as a mistake, think of it as part of the learning curve.The more you understand about how the market works, how cycles move between fear and greed, and how fundamentals support long-term stability, the less likely you are to make the kinds of mistakes that actually lead to losses. And don't forget that while profit is great, ownership itself is already a win.

If you're ready to take that next step in your property education, you can join us at the upcoming PWS Masterclass, where industry experts break down how to navigate property decisions with a clearer framework.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.