Press Release

|January 06,2026Propnex's Singapore Budget 2026 Wish List: Targeted Policy Recalibration To Further Promote Market Stability, Improve Affordability, And to Encourage Urban Renewal

Share this article:

6 January 2026, Singapore - PropNex, the largest real estate agency in Singapore has outlined a set of policy recommendations ahead of the upcoming Singapore Budget that is aimed at supporting market stability, enhancing housing accessibility and affordability, and encouraging urban renewal in Singapore's residential landscape.

The firm noted that while the housing market has remained resilient, more targeted and calibrated measures could help address certain challenges faced by varying stakeholders, including buyers and homeowners without undermining affordability or long-term sustainability.

Kelvin Fong, CEO of PropNex, said, "The healthy home sales and moderate price growth in the past year have showcased both the resilience and discipline in the Singapore property market. We believe this gives policymakers room to fine-tune existing measures, and the upcoming Singapore Budge 2026 in February presents an opportunity to tweak certain measures. They include an easing of the additional buyer's stamp duty (ABSD) rate for foreigners buying high-value non-landed private homes in the Core Central Region (CCR), the raising of the monthly household income ceiling and mortgage servicing ratio for the purchase of new executive condominium (EC), the lifting of the 15-month wait-out period, as well as supporting urban renewal via collective sale by lowering the requisite consensus threshold level, among others."

PropNex's recommendations

Reduce the ABSD rate for foreigners buying a non-landed private residential property priced $10 million and above in the CCR to 30%

The doubling of the ABSD rate for foreigners (non-PR) purchasing a residential property in Singapore from 30% to 60% in April 2023 has been effective in reining in sales of private homes to foreign buyers, particularly in the CCR which tend to attract more investment interest compared with other sub-markets.

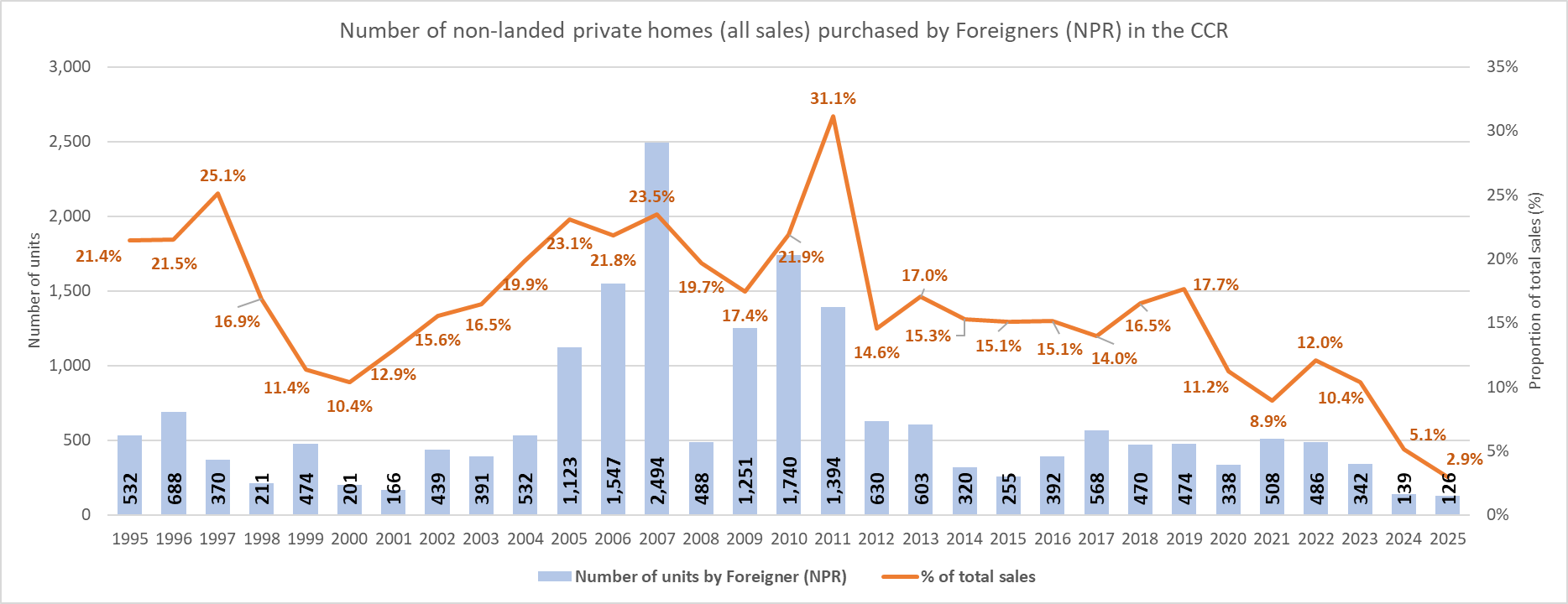

In 2025 (till 30 December), foreigners (NPR) bought 126 CCR non-landed private residential properties - accounting for about 2.9% of the non-landed home transactions (all sales, i.e. new, resale and sub-sales) in the CCR, a record low proportion since 1995 (see Chart 1), as per URA Realis caveat data. This is despite the CCR having posted a strong rebound in sales in 2025 - which is testament to the effectiveness of the ABSD measure in curbing foreign investment demand.

Chart 1: Number of non-landed private homes* (all sales) bought by foreigners (NPR) by year in the CCR and proportion over total CCR private home sales

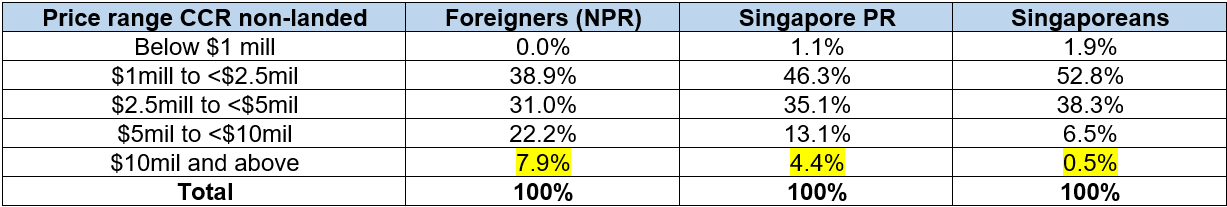

Table 1: Proportion of non-landed private homes sold (all sales) in the CCR by price range by nationality by residential status in 2025*

PropNex believes there is room to revise downwards the ABSD rate for foreigners to 30% in the ultra-luxury CCR segment, referring to non-landed private homes that cost at least $10 million each. Typically, this is a narrow segment of the market and buyers of these homes are not competing with Singaporean households. In 2025 (till 30 December), about 7.9% of the non-landed CCR private homes purchased by foreign buyers (NPR) were priced at $10 million or more (see Table 1), compared with the 4.4% and 0.5% proportions for Singapore Permanent Residents and Singaporeans, respectively.

Restoring the ABSD rate back to 30% for this niche segment may potentially help to stimulate sales at the very top-end of the market, bringing liquidity back without pushing up prices for everyday Singaporeans, who for most part do not participate in the ultra-luxury private housing market. In addition, it could bring in more residents, and enlarge the live-in population in the city - helping to inject more vibrancy and support the live-work-play vision laid out by the government. Furthermore, a reduction in the ABSD rate for foreign buyers for higher-priced units may also offer developers some visibility in demand for high-end homes and could provide a measure of confidence when they bid for CCR private housing sites.

Encourage urban renewal by lowering the en bloc statutory majority consent threshold to 70% for private residential developments that are 40 years or older

En bloc sale in Singapore is governed by the Land Titles (Strata) Act. Under the existing framework, the collective sale threshold is 80% majority consent for developments 10 years and older, and 90% for those under 10 years. The Ministry of Law has said that a review of the collective sale regime is underway.

PropNex proposes that the government consider reducing the majority consent threshold to 70% for ageing developments that are 40 years or older to facilitate the possibility of an en bloc sale. This will encourage urban renewal, rejuvenate ageing estates, and optimise land use, as well as help owners of these older properties who may otherwise be saddled with the rising cost of maintaining an ageing development with outdated facilities.

In addition, the redevelopment of much older properties may tie in with changing needs, as new buildings can have features such as barrier-free access, senior-friendly designs, facilities for modern living (e.g. co-working space), and a wider variety of unit choices. New developments also often come with lush landscaping and open spaces, which can help to refresh the look and feel of the neighbourhood.

Adjust ABSD remission deadline for housing developers for large sites to 7 years

The ABSD remission is applicable to acquisitions of sites on or after 8 December 2011 for the development of five or more units of housing accommodation, if remission conditions are met. Presently, developers are required to pay 40% ABSD of which, 35% ABSD may be remitted upfront subject to conditions (the other 5% is non-remittable). Developers have to sell all units in the project within five years from site acquisition to obtain ABSD remission (35%). With effect from 16 February 2024, eligible projects with at least 90% of units sold at the five-year sale timeline will be subjected to a lower clawback rate on the ABSD remission.

The government has also provided targeted extensions to the ABSD remission timelines for developers, as announced in March 2025. These extensions - ranging from six months to a year - are primarily for complex, large-scale projects, or those adopting new construction technologies. Housing developers of private residential projects submitted through CORENET X are eligible for a 6-month extension to their ABSD remission timelines, if they meet the stipulated requirements.

While these changes have been timely, PropNex believes there may be scope to further fine-tune the policy, by providing for a longer ABSD remission deadline extension by two additional years - to seven years - for massive land plots that are 80,000 sq m or larger. For instance, private residential projects like Braddell View sits on a site spanning over 100,000 sq m, while Pine Grove and Mandarin Gardens have site areas of nearly 83,000 sq m and 100,000 sq m, respectively.

These projects have repeatedly been launched for collective sale over the years without success, partly due to a mismatch in price expectations, the sprawling land size, as well as considerable development and financial risks that developers may potentially face. Developers risk paying hefty financial penalties if they are unable to sell all new units - in what will certainly be a mega development - within the ABSD remission deadline of five years. By extending the remission timeline to seven years, developers will have more time to market units and may be more confident to undertake larger and more ambitious projects. Again, this can help to serve a broader agenda of urban renewal and encouraging large-scale redevelopments that may have a transformative effect on the neighbourhood.

Raise the mortgage servicing ratio (MSR) from 30% to 40% for eligible buyers purchasing new executive condos (EC) from developers

The MSR refers to the portion of a borrower's gross monthly income that goes towards repaying all property loans. At the time of writing, the MSR is capped at 30% of a borrower's gross monthly income and only applies to home loans for the purchase of an HDB flat or an EC (where the minimum occupation period of the EC has not expired).

It is a measure aimed at ensuring that buyers are prudent in their property purchase, and do not overstretch themselves financially. The MSR was first set at 40% during its inception, and it was eventually brought down to 30% in 2013 for housing loans granted to HDB flat and new EC buyers, and it has stayed at that level since.

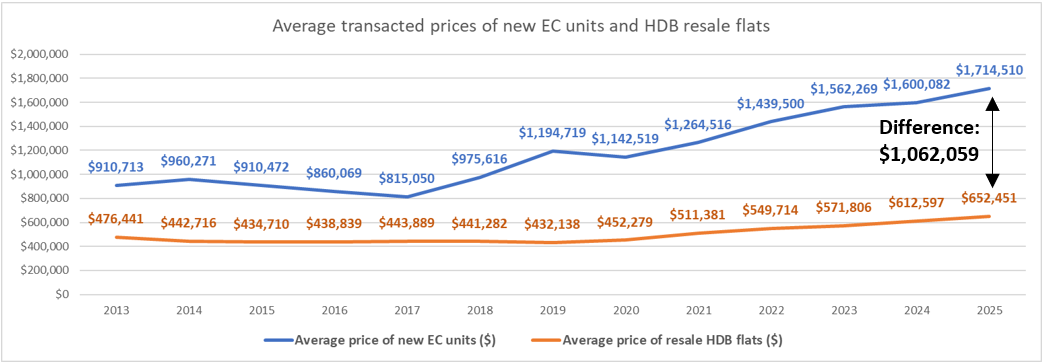

In view of the rising prices of new ECs, PropNex believes the MSR for new EC purchases is due for a review to ensure a fairer reflection of prevailing prices. From 2013 to 2025 (till 28 December), the average transacted price of new EC units has jumped by 88% from $910,713 to about $1.715 million (see Chart 2), as per caveats lodged. Meanwhile, the average HDB resale price rose by nearly 37% from $476,441 in 2013 to $652,451 in 2025, according to transaction data.

Chart 2: Average transacted price of new EC units and HDB resale flats by year

Source: PropNex Research, URA Realis (till 28 December 2025), data.gov.sg (retrieved on 6 January 2026) New EC prices have risen substantially in the past years, owing to higher EC land costs, construction expenses, and strong market demand for such units. In contrast, resale HDB prices - which have seen a relatively more gradual growth -remain markedly lower than new ECs in general. Notably, the average land rate for the three government land sales (GLS) EC sites awarded in 2025 was $748 psf per plot ratio, compared with an average of $360 psf ppr for five EC plots sold in 2013.

In view of the large price disparity between the two housing types, it is reasonable to consider adjusting the MSR upwards for new EC purchases to 40% to improve home financing ability, while keeping the MSR for HDB flats at 30% to ensure prudent borrowing.

Increase the monthly household income ceiling for new EC purchase in two-step from $16,000 to $18,000 first, and then potentially to $20,000 a year later

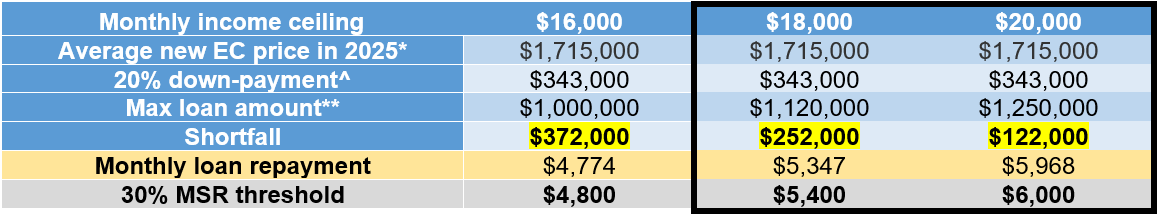

The government has said that it is reviewing the monthly household income ceiling for new public housing flats (presently at $14,000 for families). PropNex hopes that policymakers will similarly look into adjusting the same for new EC buyers. At the prevailing household income ceiling of $16,000 per month, prospective EC buyers would be able to secure a bank financing of around $1,000,000 based on an MSR of 30%, a medium-term interest rate floor at 4% p.a., and a 30-year loan tenure (see Table 2).

Factoring in the bank loan amount, there would still be a shortfall of $372,000 to be paid, after the buyer puts a 20% downpayment of $343,000 under the Deferred Payment Scheme (DPS), assuming the EC purchase price at $1.715 million (which was roughly the average transacted price of new ECs in 2025, till 28 December).

Based on the illustration, the total downpayment ($343,000) and shortfall amount ($372,000) would come up to a total of $715,000 which the EC buyer has to pay in a combination of cash and monies from their Central Provident Fund (CPF) accounts. This represents a substantial sum for many couples, and may put new EC units out of their reach, if they do not have enough savings or access to financial help from family members.

Should the monthly income ceiling be raised to $18,000 and holding other factors constant, the downpayment and shortfall amount will fall to $595,000, and may be reduced further to $465,000 if the income ceiling is lifted to $20,000 per month. However, it will also mean that buyers will see an increase in their debt obligations, with higher monthly home loan repayments.

Table 2: Illustration on new EC purchase financing at various household monthly income ceiling amounts

**loan amount based on MSR of 30%, 4% p.a. interest, and 30-year loan tenure, ^Applicants buying a new EC unit under the Deferred Payment Scheme pays a 20% downpayment using cash and CPF during the signing of the S&P agreement. The remaining amount will be paid when the project attains Temporary Occupation Permit (TOP)

Lifting the 15-month wait-out period now that the HDB resale market has cooled

The 15-month wait-out period was introduced in September 2022 as part of a package of cooling measures. It requires former private home owners who have sold their private residential property to wait for 15 months before they could buy an unsubsidised resale HDB flat (with exceptions for seniors who intend to purchase 4-room or smaller resale flats). The government has indicated that this is a temporary measure and National Development Minister Chee Hong Tat has said private property owners may not need to wait till 2027 or 2028 for a review.

With HDB resale flat prices growing at a slower pace and transaction volume moderating, PropNex believes that it may be timely to remove the 15-month wait-out period in 2026. Based on the HDB resale price index flash estimates, resale flat prices rose by a cumulative 2.9% in 2025 - significantly lower than the 9.7% increase in 2024. Meanwhile, an estimated 26,042 public housing flats were resold in 2025 (till 30 December) - lower than the 28,986 resale flats transacted in the entire 2024.

Additionally, the increase in the number of flats reaching their 5-year minimum occupation period (MOP) in 2026 to 13,500 units (from 8,000 units in 2025) may help to ease HDB resale price pressure and offer prospective buyers with more options. The lifting of the 15-month wait-out period will help private homeowners who wish to right-size their home, and may possibly be beneficial to the en bloc sale process, as private homeowners will be able to channel the sale proceeds to purchase a resale flat as a replacement home, without being stuck waiting.

PropNex's recommendations are guided by a clear objective: to ensure that Singapore's housing market remains sustainable, accessible, and aligned with the evolving trends and changing needs of households.

"Singapore's tiered housing system provides options for every budget, ensuring that everyone can find a home that meets their needs. By fine-tuning existing measures and policies in line with current market conditions, we believe Singapore can continue to keep housing affordable for its citizens, support responsible homeownership, and ensure the long-term resilience of the residential property market," Mr Fong added.